What are digital currencies or cryptocurrencies?

In an era where traditional cash transactions have decreased in favor of electronic transactions and payments, a phenomenon known as digital currencies or cryptocurrencies emerged. Despite initial skepticism due to their virtual and electronic nature, they gained increasing acceptance and demand, causing the prices of digital currencies to reach unprecedented levels that were once unimaginable. They also made their way into international financial transactions, piquing the curiosity and interest of everyone. In this article, we will shed light on the concept of digital currencies and how to engage with them.

The Concept of Cryptography

Before delving into digital currencies or cryptocurrencies, let’s acquaint ourselves with the concept of cryptography, which is attributed to the method of creating and using these currencies.

Cryptography is originally a means of safeguarding information and data through the use of codes, making it unreadable or indecipherable to anyone except those targeted with the information and possessing the decryption key that enables them to process these codes to reveal the original information. The word “cryptography” can be translated by breaking it down into “crypt,” which means hidden, and “graphy,” which means writing, signifying that the term refers to content written in a way that conceals its meaning.

In essence, it involves concealing data from its usual and publicly known context into another context unknown to the general public, preserving the confidentiality of its content. This is not a new process, as the principle of encryption has been used in various diplomatic and military fields in ancient times and has numerous modern financial and informational applications. This leads us to the digital currencies built upon the same concept.

The Difference Between Decryption and Cryptanalysis

In contrast to encryption, we have decryption, which is the process of returning the encrypted context to its original content in its usual and readable form by the public before the encryption process. This is achieved using an encryption key.

With the advancement of mathematics, computer science, and communications, encryption and decryption have become reliant on complex mathematical algorithms that are difficult to solve. Even if the science of breaking the code or solving these algorithms – without decrypting them in the manner they were originally prepared – is theoretically available, it is practically impossible using current known computational means. This is the reason for the continued assumption of their security and confidentiality until now.

This is what is known as cryptanalysis, which involves studying the decryption algorithms and their applications to obtain the content of encrypted information or assets and their source without access to the required key to do so.

In summary, we can simplify the difference between decryption and cryptanalysis to the fact that decryption means restoring the context of encrypted symbols to their original state using the encryption key prepared from the beginning to re-translate these symbols to what they were. On the other hand, cryptanalysis is an attempt to decipher those symbols through trial and error numerous times to reach a solution for the encryption algorithm to translate the encrypted symbols and determine the original context without knowing the key.

How did the idea of electronic cash transactions begin?

Based on the concepts of encryption, decryption, and cryptanalysis, the idea of creating cryptocurrencies, which are digital virtual currencies encrypted for secure and private transactions, was born. These cryptocurrencies are created and stored electronically without the oversight of a regulatory authority or central bank controlling them. Unlike conventional currencies issued by central banks, such as the Saudi Riyal (SAR), Euro (EUR), or the US Dollar (USD), cryptocurrencies lack a tangible physical entity.

The concept of digital or electronic alternatives to conventional cash transactions began in the late 1980s, primarily in the Netherlands at a series of fuel supply stations or gas stations along highways where many robberies were occurring. The management sought a solution to this problem and enlisted a group of programmers and developers to link money to special cards. Through these cards, drivers who wished to conduct transactions at these stations could obtain fuel without the need for paper currency. Consequently, the use of physical cash at these stations decreased significantly, reducing theft incidents. This idea then evolved into the concept of smart money cards, reflecting the idea of electronically encrypted money stored on the card. At the fuel station, there would be a device to decrypt this code, which is known today as a point-of-sale (POS) system. This represents the earliest form of electronic money, which has since evolved into its current state.

The beginning of the idea of digital currencies or cryptocurrencies

Continuing the idea of electronic transactions, around the same time or slightly before, there was an idea circulating in the mind of an American programmer named David Chaum. The essence of this idea revolved around financial privacy and an attempt to simulate physical or paper currencies into digital tokens with the same capability to conduct secure and private transactions, allowing money to transfer from one hand to another discreetly. He invented an algorithmic formula through which funds could be transferred invisibly and untraceably using a token currency he called “Chaum” at the time. Following this, Chaum established DigiCash as a fundamental framework to execute these operations, which continued for years until several mistakes led to DigiCash’s bankruptcy in 1998. Nonetheless, he laid a strong foundation for the concept of algorithmic formulas for tokenized cash transactions or digital currencies.

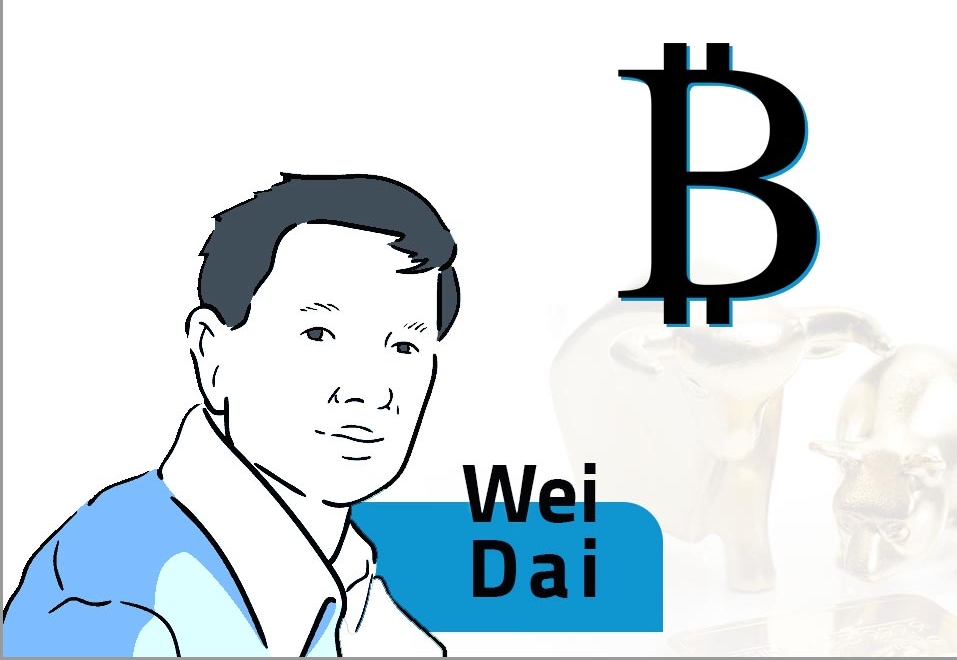

In furtherance of the same concept, another programmer named Wei Dai began to propose the idea of an integrated, untraceable, and hidden cash system that emphasized privacy and security. He named it “B-money,” where transactions occurred through pseudonymous names to analyze currencies within a decentralized network. He indeed presented a whitepaper for his project; however, the idea did not gain the desired reception and popularity, and it did not succeed. It is worth noting that the whitepaper Satoshi Nakamoto presented for the idea of Bitcoin, which we will discuss in detail in a later article, contained some elements mentioned in the whitepaper for the B-money project. This indicates that it was the true starting point for the race towards the evolution of digital currencies.

The Emergence of Digital Currencies

With the path paved for the creation of digital currencies, technological and computational advancements led to the birth of complex encryption protocols based on advanced mathematical and computer science principles. These protocols made it theoretically almost impossible to break and were relied upon by digital currency programmers through highly intricate encoding systems. These systems encrypted data transfer operations to secure their proprietary units of exchange. Moreover, they possessed the capability to conceal the identities of the transacting parties, ensuring that transactions, transfers, and financial flows remained anonymous, thus fulfilling the primary principle of privacy that has been the goal from the outset.

In this way, we can say that digital currency is computer software, but it’s decentralized. This means it’s not installed or built on a specific device; rather, it’s distributed and hosted on numerous computers owned by individuals worldwide, rather than being hosted on a single server by a specific individual or company.

The supply and value of digital currencies are controlled through the activities of their users by means of highly complex encryption protocol codes. Every functional aspect or transaction, from how transactions are recorded to how data is stored, is condensed into a specific programmatic code, typically stored in a type of database known as a blockchain. This blockchain serves as a comprehensive, distributed, protected, and hidden ledger for all data and transactions related to the digital currency. By processing these algorithms in general, the digital currency is granted to the user who adds transactions to the blockchain network.

It’s important to note that one of the key distinguishing features of most digital currencies, though not all, is that they have limited numbers of units. This means that most digital currencies were produced with the concept of having a market cap, in other words, an initial creation that includes a specific number of units. With each decryption process or mining through the addition of a transaction, the supply gradually decreases. This concept is similar to the idea of precious metals; for example, the more gold is extracted, the scarcer it becomes underground. It becomes increasingly difficult for miners to produce units of digital currency until the upper limit is reached, at which point the currency ceases to be created altogether.

To simplify this concept, Bitcoin, one of the most famous digital currencies and currently the most valuable, was encoded from the beginning with only 21 million pieces. Once all of them are mined or extracted, there will be no new Bitcoins printed, unlike traditional currencies. This means that if you own 1 Bitcoin, you own 1/21,000,000 of the total wealth of the world in Bitcoins.

Advantages of digital currencies

Here are the most prominent advantages of dealing with digital currencies that have emerged with their recent proliferation:

Protection Against Loss of Value or Inflation:

Inflation is a scourge of global economies, and many traditional currencies have faced and continue to face the risk of inflation. However, the concept that digital currencies are produced with a predetermined market cap and a limited quantity of them increases their value as demand rises, which protects them from long-term inflation.

1.

Self-Governance and Sustainable Maintenance:

The management and maintenance of any currency are key factors in its development and sustainability. In digital currencies, transactions are stored by miners in the blockchain network on their computers, and they receive the currency itself as a reward. Consequently, they keep transaction records accurate and up to date, ensuring the decentralized integrity and security of the digital currency.

2.

Security and Privacy:

As mentioned in our previous article, security and privacy were the primary motivations for building digital currencies from the ground up. The records in a blockchain network are based on various encryption algorithms that are difficult to decrypt or analyze. This makes digital currencies more secure than regular electronic transactions, and they also use pseudonyms or unlinked account numbers that are not associated with any user or stored data, enhancing privacy.

3.

Ease of Exchange:

One of the most important advantages is the ability to easily exchange digital currencies for traditional currencies as an equivalent value. Each of them has a variable exchange rate with major global currencies such as the US Dollar (USD), British Pound (GBP), Euro (EUR), or Japanese Yen (JPY). This versatility has helped their spread and acceptance as alternatives to traditional cash transactions, providing equivalence in value.

4.

Decentralization:

In contrast to traditional currencies or mandatory fiat currencies controlled by governments through central banks, digital currencies are inherently decentralized. They cannot be controlled, increased in quantity, stopped from use, or made available except by those who use them and hold the majority of them. This is achieved through the organization that creates or develops them before introducing them to the market. It helps maintain them against monopolization and ensures their stability, privacy, transparency, and security.

5.

Low Transaction Costs and Speed:

One of the primary uses of major digital currencies is transferring money, and the cost or fees of transfers is one of the most important factors in evaluating the quality of a transfer system or process. In digital currency exchanges, transaction fees paid by users are reduced to a small amount, or perhaps even zero, and transactions occur directly between users’ accounts with great speed. Therefore, there is no need for third parties like VISA or SWIFT to verify the transaction, eliminating the need for additional transaction fees or long waiting times.

6.

Drawbacks of Digital Currencies

Despite their advantages, dealing with digital currencies comes with certain drawbacks that should be considered before using or investing in them. Here are some of the drawbacks:

Ease of Use in Illegal Transactions:

The absolute security and privacy that characterize digital currencies make it difficult for governments to trace any user through their wallet address or access their data. It’s worth mentioning that Bitcoin has been used as a means of exchanging money and financing many illegal transactions. Some individuals also use digital currencies for money laundering, acquired through unlawful means, to hide their source.

1.

Data Loss Can Result in Huge Financial Losses:

Developers of digital currencies aimed to create source code with encryption algorithms that are untraceable and authentication protocols that are unhackable. The goal was to make storing money through digital currencies more secure and private than traditional cash. However, the other side of this level of privacy is that if a user loses the private key to access their digital wallet or account, it cannot be recovered. The wallet remains locked with the cryptocurrencies inside, essentially making them irretrievable.

2.

Some Digital Currencies Cannot Be Exchanged for Traditional Currencies:

This lack of exchangeability can be a disadvantage, as some digital currencies can only be traded for one specific currency or a limited set of currencies. This forces users to convert these digital currencies into one of the major cryptocurrencies, such as Bitcoin or Ethereum, first, and then into the desired currency through specialized exchanges. This can incur additional transaction fees or commissions during the process, costing unnecessary money.

3.

Negative Environmental Impact of Mining:

The process of mining digital currencies is complex and requires modern and advanced computers, making it energy-intensive. It cannot be performed on regular computers. Miners of cryptocurrencies like Bitcoin, particularly those in countries like China that use coal for electricity production, contribute significantly to China’s carbon footprint.

4.

Vulnerability of Digital Currency Exchanges to Hacking:

Despite the security and privacy of digital currencies themselves, their exchanges are not as secure. Most exchanges store user wallet data to operate their user identification properly. Skilled hackers can infiltrate these databases, gaining access to and possibly stealing the stored digital currencies. Some exchanges, like Bitfinex and Mt. Gox, have been hacked in the past, resulting in the theft of thousands, equivalent to millions of US dollars in Bitcoin. Most exchanges are highly secure now, but there is always the possibility of another breach.

5.

No Refund or Cancellation Policy:

Financial transactions involving digital currencies are similar to other financial transactions. If there’s a dispute between parties or if someone sends funds to the wrong wallet address by mistake, the sender cannot recover the sent digital currencies. This can be exploited by scammers to swindle money. Since there are no refunds or reversals in the process, it’s easy to create a transaction for a product or service that was never delivered or provided.

6.

Today, there are more than 1,324 encrypted digital currencies in the markets. Despite being virtual electronic currencies, they have become prevalent in online transactions and have been accepted by many global businesses, with Bitcoin leading the way.

In the upcoming lessons and articles, we will learn more about the most famous digital currencies, their creation, mining, and trading processes.