Potential movement directions for Bitcoin trading: Chances of bullish correction ending

In yesterday’s trading, confidence in the US economy witnessed a decline and negativity as the American consumer confidence reading dropped to 106.1 compared to expectations of 116.0. The previous reading was around 114.0. At the same time, we also saw a decrease in employment opportunities reported by the US economy, as the US job openings index reached 8.827 million compared to market expectations pointing to 9.465 million. The previous reading for the index was about 9.165 million. This supports the idea of the Federal Reserve maintaining the current interest rates during the upcoming September meeting, which the markets view negatively in terms of US dollar futures trading. On the other hand, Bitcoin benefited from this situation and rose to levels of 28,136.

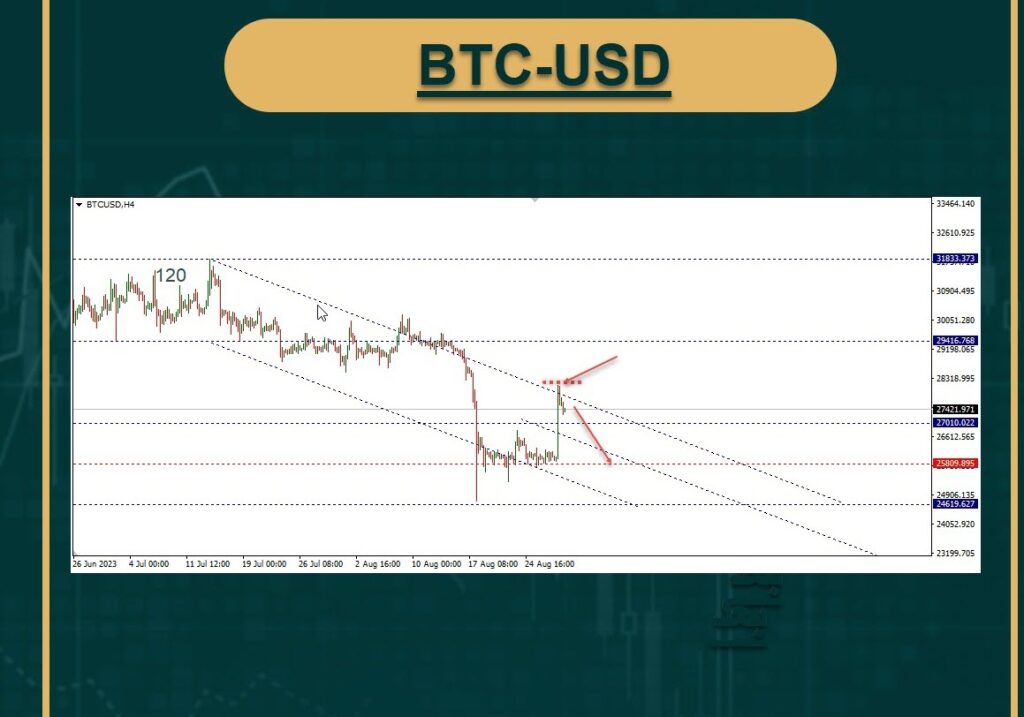

Technical Outlook:

In previous trading sessions and in a prior analysis, the importance of anticipating an upward correction was confirmed, which could extend to levels around 27,010 and reach the upper limit of the descending channel. Currently, prices are trading below the lower limit of the descending channel, approximately around 27,445 levels. According to the main scenario, there is a possibility of resuming the decline from the current levels, targeting the initial level of 25,809. If prices manage to align with the main scenario and break the first target, we might witness further potential declines to reach 24,619. The main scenario aligns with the condition of two consecutive 15-minute candle closes above 28,136 levels.

One Comment