FTX Collapse Sends Shockwaves Through Crypto Industry: Pantera Capital Acquires SOL Assets

The collapse of FTX in 2022 marked a significant event in the cryptocurrency industry, triggering major changes and sharp declines in some assets. The aftermath of this massive company’s collapse continued, with recent auctions and the sale of SOL assets to Pantera Capital. Here’s a closer look at the details:

FTX and Its Downfall:

The year 2022 brought grim news for cryptocurrency companies, with one of the major casualties being FTX Holdings, which filed for bankruptcy, leading to widespread industry distrust. As the largest cryptocurrency exchange, its impact was felt due to decreased investments in the crypto market.

However, the repercussions of its collapse didn’t end there. Investors, courts, and regulatory authorities continued to grapple with numerous issues left in its wake. One recent development was the liquidation of its assets to compensate investors.

In a recent move, investment capital firm Pantera Capital purchased an undisclosed amount of SOL tokens from FTX Holdings. Neither Pantera Capital nor FTX Holdings has issued an official statement regarding the exact figure of the purchase as of yet.

Liquidation of SOL Holdings:

This deal comes as part of the ongoing process of liquidating the assets of the mentioned company. Multiple transactions were conducted to ensure repayment to investors and creditors. The liquidation process, spanning several stages, is expected to dispose of assets valued at around $2.6 billion.

Recent news revealed the sale of some assets to Pantera Capital and Galaxy Digital, at a significant discount, causing surprise among various circles. Of particular concern are the creditors hoping to recover their funds, as the sale of assets at reduced prices prompted fears among former creditors.

Details regarding the sale have not yet been disclosed by Pantera Capital. Despite the deal being finalized and confirmed by Bloomberg, there has been no official announcement from Pantera Capital or FTX Holdings.

Furthermore, there is a potential opportunity for the sale of more assets in the near future. Given the institutional investor demand for SOL tokens, there may be a chance for competitive bidding from investors and buyers.

Currently, FTX holds over 41 million SOL tokens to be liquidated to repay creditors. The process will take a considerable amount of time and will be released into the market over a span of four years.

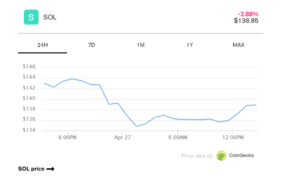

The price of SOL has risen, raising hopes for the recovery of investor funds, witnessing an increase of nearly 1300% over the past year.

Conclusion:

Pantera Capital has completed the purchase of a significant number of SOL tokens. According to Bloomberg’s update, they managed to acquire approximately 2000 SOL tokens after closing the deal. With the ongoing auction of FTX assets, it has had a significant impact on the cryptocurrency market, with allegations of creditor rights violations emerging.

Important Notice: The content of this article is for informational purposes only and should not be construed as financial advice. Chinwa.tech assumes no responsibility for any investment decisions made based on the information provided herein. It is strongly advised to seek the guidance of a qualified specialist or financial advisor before making any investment choices.

One Comment