Solana (SOL) Surpasses Ethereum L2s in Trading Volume, Spurring New Summer of Solana”

Solana (SOL), a high-performance blockchain network, has finally surpassed Polygon and Optimism in terms of transaction volume, triggering discussions among traders and analysts about the roots of the “new summer of Solana” as all key metrics for activity on the chain soar dramatically, with some already reaching pre-FTX crash levels. Data suggests that NFT slices and meme coins may be contributing to this surge.

Solana (SOL) Overtakes Polygon (MATIC) and Optimism (OP) in Trading Volume

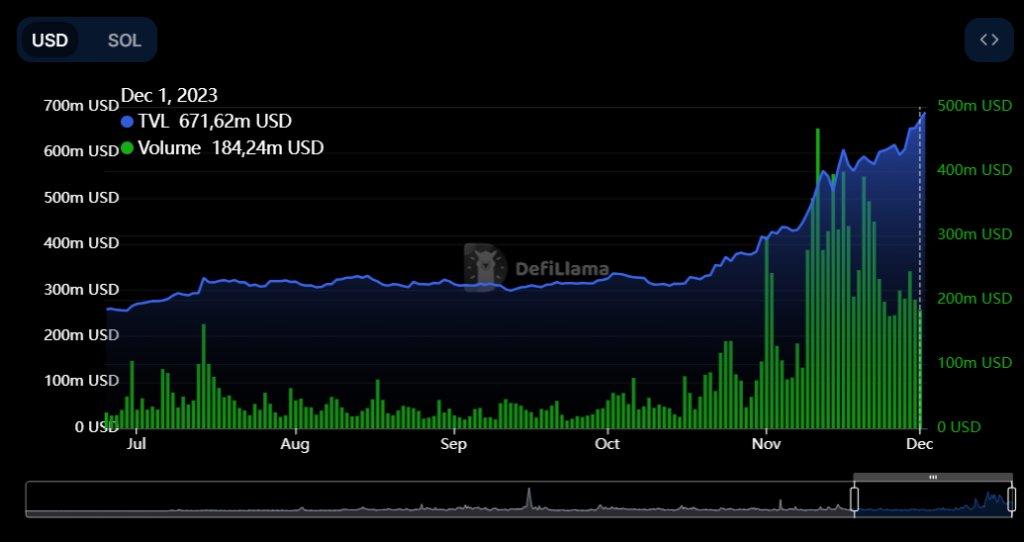

In early December 2023, the total trading volume across the Solana (SOL) blockchain reached an equivalent of $240 million daily. In doing so, the blockchain managed to surpass both Polygon (MATIC) and Optimism (OP), two prominent Ethereum-based L2s, through this metric.

In the early days of December, both Polygon (MATIC) and Optimism (OP) exhibited trading volumes of $137 million and $40 million daily, respectively. Consequently, Solana (SOL) is handling more money across the chain compared to what they collectively do.

Moreover, in the past 24 hours, Solana (SOL) surpassed its other competitor Avalanche (AVAX) in terms of total value locked (TVL) in decentralized applications. Solana’s dApp ecosystem accounted for $688 million in TVL, while Avalanche (AVAX) dApps recorded $660 million. At this pace, Solana (SOL) may surpass the TVL values of Polygon (MATIC) and Optimism (OP) in the coming days.

In the last month, Solana (SOL) added over 60% to its TVL, with the price of SOL rising by 45%.

However, it still lags behind Arbitrum (ARB), the dominant Ethereum (ETH) L2 token. Arbitrum (ARB) garnered nearly $2.2 billion in TVL, while its daily trading volume surpasses an equivalent of $363 million.

SolScriptions and meme coins contributed to Solana’s return (SOL).

The surge in Solana (SOL) and its network indicators can be attributed to a set of strong catalysts. For example, interest in Ordinals “SolScriptions” and Solana-based meme coins led to the growth of SPL tokens minted on the chain.

Subsequently, liquid staking protocols built on Solana such as Jito and Marinade Finance are attracting new clients and liquidity. Additionally, decentralized exchanges like Raydium and Orca are gaining more attention.

READ MORE "Solana and Dogecoin Show Resilience as Bitcoin Struggles"

As previously covered by U.Today, CoinEx Research pointed to the DePIN sector (decentralized physical infrastructure networks) as another strong catalyst for the Solana (SOL) ecosystem’s resurgence.

Important Notice: The content of this article is for informational purposes only and should not be construed as financial advice. Chinwa.tech assumes no responsibility for any investment decisions made based on the information provided herein. It is strongly advised to seek the guidance of a qualified specialist or financial advisor before making any investment choices.