Understanding the Impact of Bitcoin Halving on Miners and Market Dynamics

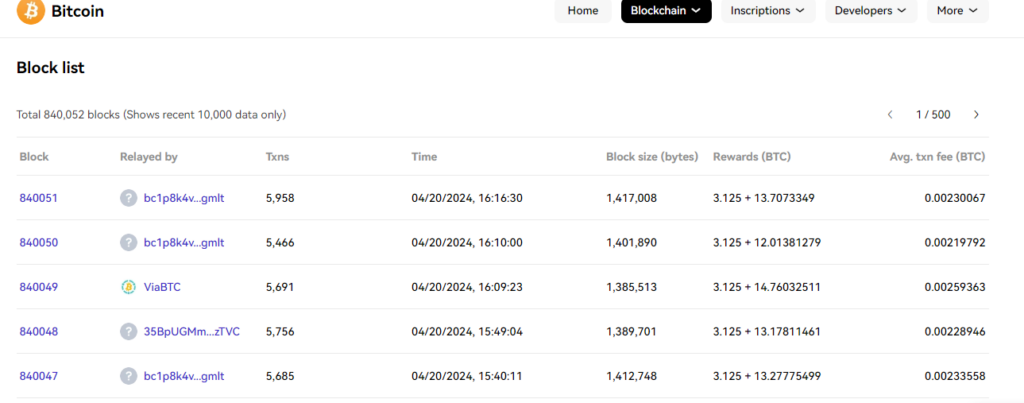

Bitcoin halving events, characterized by a reduction in block rewards, have far-reaching implications for both miners and the cryptocurrency market at large. As transaction fees rise, they constitute a significant portion of revenues, prompting close scrutiny from mining operators. The most recent halving event on April 19, 2024, brought substantial rewards for many miners, with those appointed after this latest halving event potentially reaping greater rewards. Notably, block rewards surged to 21.74 bitcoins, with transaction fees emerging as a primary driver of this growth.

Effects on Bitcoin Miners Post-Halving

The latest halving led to a substantial reduction in the Bitcoin block reward from 6.25 to 3.125 bitcoins per block. This adjustment marked a crucial step in slowing down the overall supply growth, as part of Bitcoin’s design to limit the total supply to 21 million coins, a move often seen to bolster the cryptocurrency’s price in the long run.

Fluctuating price rates may signal an increasing cost of transaction processing within the network, potentially reflecting rising demand or decreased transaction throughput per block.

By fostering the development of the Bitcoin community and financial journalism that takes into account the consequences of Bitcoin halving events, such occurrences are expected to further propel the upward momentum in the cryptocurrency realm. However, the extent of the impact of rising migration costs on migration patterns over time remains uncertain. Responsible investors and analysts now monitor market dynamics and miner behavior to link it to the future price and stability of Bitcoin.

The Future of Bitcoin’s Financial Landscape Post-Halving

The increase in transaction fees as a percentage of total block revenues sheds light on the variable dynamics in miner compensation. This change may affect mining activity, especially in regions where electricity costs may outweigh the benefits of mining operations.

These higher fees may incentivize the deliberate development of second-layer solutions such as the Lightning Network, which focuses on reducing costs and speeding up transactions on the blockchain.

As the cryptocurrency space grapples with a new financial landscape post-halving, the longer-term mission of securing the network and the profitability of miners, along with the transaction fees affected by this situation, will be further revealed.

Bitcoin miners are content with the post-halving results – more block rewards; however, new challenges and opportunities arise from the reward now for all participants in the Bitcoin ecosystem.

Bitcoin halving events represent more than just a reduction in miners’ revenues; they also impact investors by expanding the market and acquiring more and more customers on the other hand. Thus, these events serve as important indicators of the evolving nature of blockchain technology and its financial structures.

Important Notice: The content of this article is for informational purposes only and should not be construed as financial advice. Chinwa.tech assumes no responsibility for any investment decisions made based on the information provided herein. It is strongly advised to seek the guidance of a qualified specialist or financial advisor before making any investment choices.