Bitcoin Market Poised for a Major Rebound, Analyst Predicts New All-Time High

The Bitcoin market may be on the verge of a significant recovery as a prominent market analyst predicts an imminent rise to a new all-time high.

According to analyst Miky Bull, the recent downtrend in Bitcoin might be short-lived. He suggests that Bitcoin could surge to a record-breaking high of over $80,000, placing the bulls in full control of the market. In the past 24 hours, Bitcoin has seen a 3% increase, with a 7.5% recovery from its recent low of $52,859, recorded on September 6. Miky Bull’s analysis points to a continued upward trend, as he identifies a bullish pattern on the higher time frame.

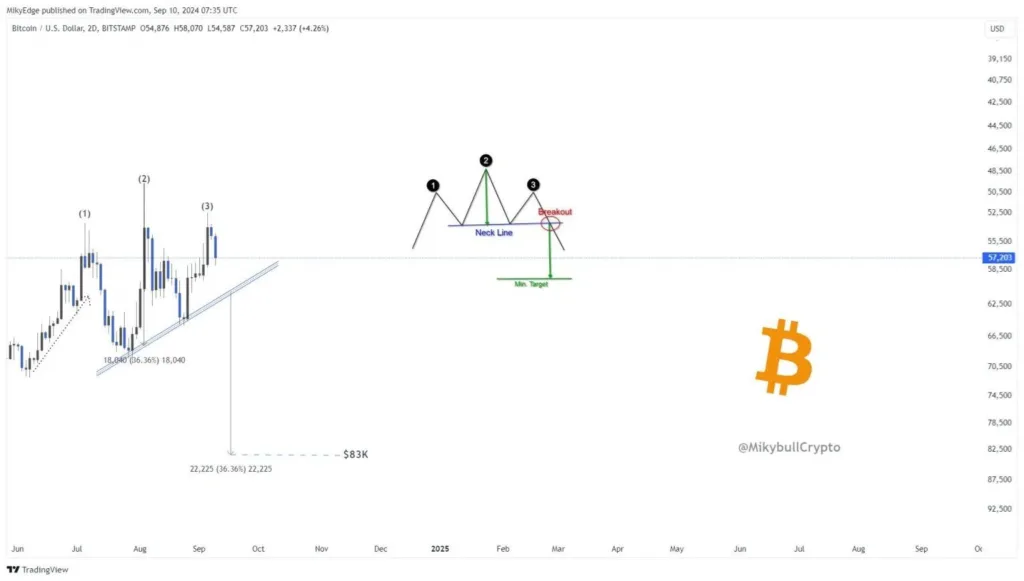

On Tuesday, Miky Bull shared a chart of the BTC/USDT pair, showing a two-day inverse head-and-shoulders pattern. This chart indicated that Bitcoin might be heading towards $83,000—a new historical peak—if it maintains its current course.

A Market Rebound?

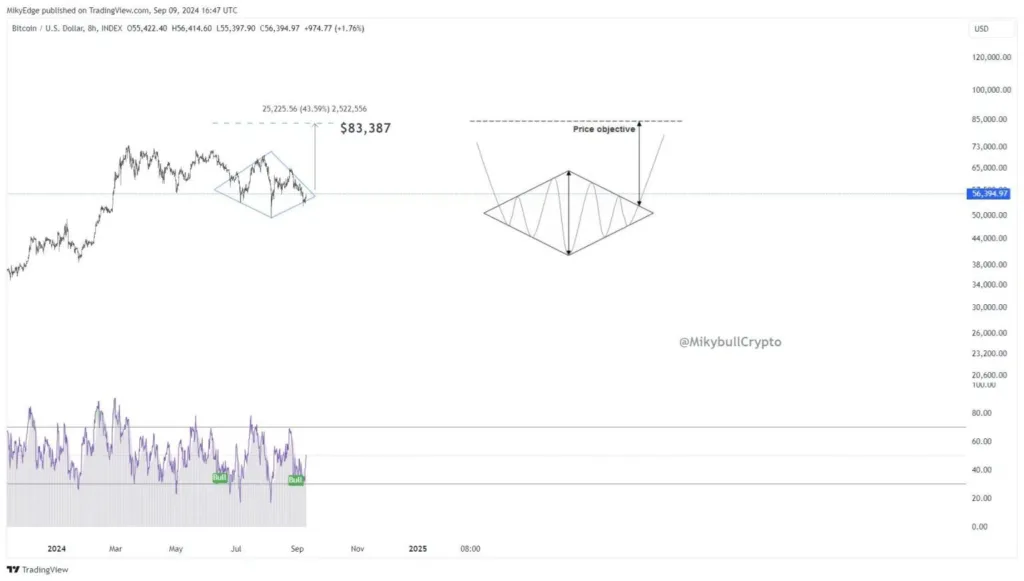

Miky Bull’s Tuesday analysis aligns with his earlier prediction of an imminent breakout from the bullish diamond pattern observed on Bitcoin’s 8-hour time frame the previous day. This breakout could push Bitcoin’s price to $83,387, closely matching today’s forecast.

A rise to $83,000 would surpass the $73,300 price target set by veteran trader Peter Brandt, which could lead to a shift in market sentiment. As reported previously by The Crypto Basic, Brandt mentioned that Bitcoin needs to break its previous all-time high to signal the activation of his “megaphone” pattern and return to an upward trajectory.

Brandt’s analysis predicted a drop to $54,300, followed by a rise to $57,300, which has played out over the past few days. However, the seasoned expert cautioned that rejection from resistance at the $57,300 level could prompt Bitcoin to retest lower prices.

Read more Will Bitcoin’s Price Rebound Amid Potential September Rate Cuts?

It’s also worth noting that Bitcoin’s price movement aligns with the forecast of analyst Michael van de Poppe. Bitcoin was rejected at $58,041 earlier on Tuesday, but it continued to trade above $57,000 at the time of writing. Bitcoin was trading at $57,041, with a 45.8% increase in its 24-hour trading volume. The majority of this volume came from centralized exchanges, with approximately $33.76 billion traded on CEX and only $100 million on DEX.

Important Notice: The content of this article is for informational purposes only and should not be construed as financial advice. chinwa.tech

assumes no responsibility for any investment decisions made based on the information provided herein. It is strongly advisç zed to seek the guidance of a qualified specialist or financial advisor before making any investment choices.