Bitcoin Whales Amass $1.6 Billion in BTC Within 48 Hours Amid Market Dip

In a significant accumulation move, Bitcoin whales have gathered over $1.6 billion worth of BTC in just 48 hours, viewing the ongoing market downturn as a “buy the dip” opportunity. Market analyst Ali Martinez highlighted this trend in a recent post on X, citing data from market intelligence source Santiment. Martinez revealed that these whale addresses have acquired 30,000 BTC tokens valued at $1.62 billion during this period.

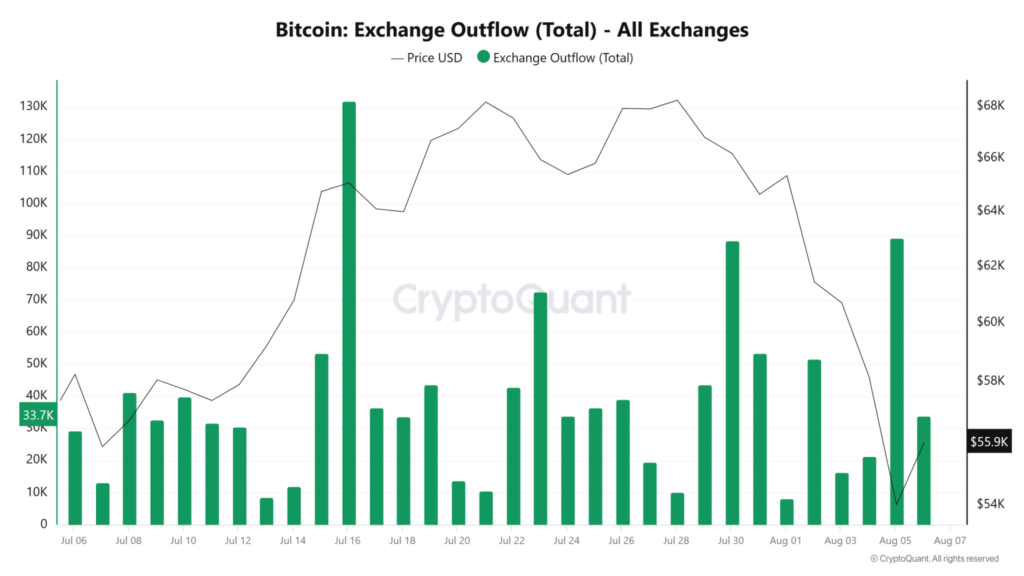

Recent data from CryptoQuant further underscores this trend, showing a substantial increase in Bitcoin outflows from exchanges. Notably, last month saw exchange outflows peak at 131,907 BTC, the highest since March 1st. However, outflows declined sharply in July and into August. On August 5th alone, exchanges recorded outflows of 89,378 BTC as Bitcoin’s price fell to $54,000. Currently, total exchange outflows stand at 33,788 BTC.

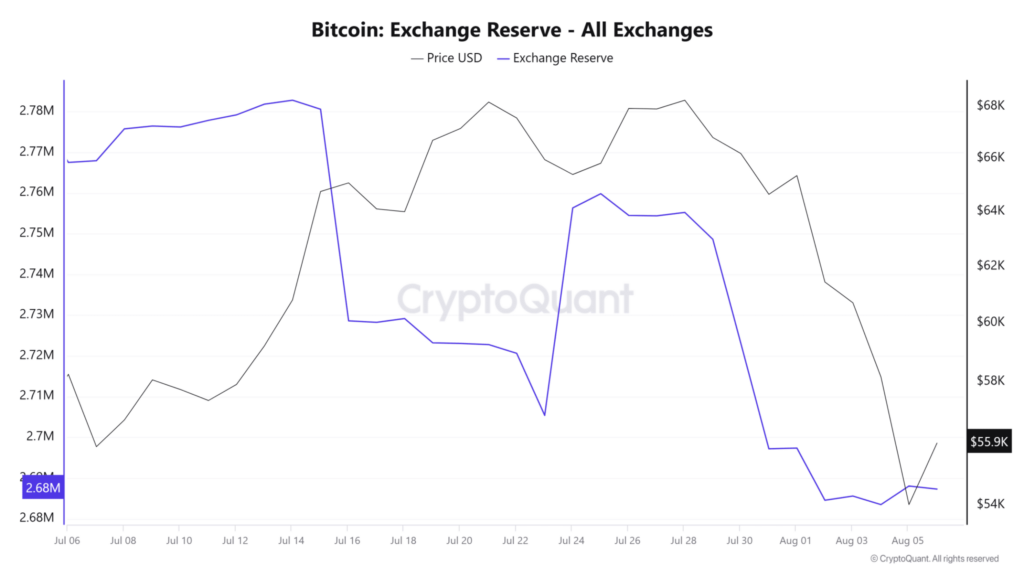

As a result of these outflows, Bitcoin reserves on exchanges have continued to deplete, dropping to 2.687 million BTC—the lowest level in years. This ongoing decline signifies the continued accumulation by Bitcoin whales.

Analysis from IntoTheBlock supports this trend, revealing that large investors holding between 1,000 and 10,000 BTC have been buying the dip amidst Bitcoin’s recent crash. These addresses have steadily increased their holdings since August 1st and now own 4.79 million BTC. In contrast, smaller addresses holding less than 1 BTC have continued to sell their tokens, a typical behavior during market downturns.

Most analysts view this pattern as bullish. The exodus of less convicted investors allows stronger hands to consolidate their positions, potentially providing the bulls with the strength needed for a recovery. Veteran trader Peter Brandt from The Crypto Basic predicts a significant upcoming surge that could push Bitcoin above its recent all-time high, potentially exceeding $92,000. At the time of writing, Bitcoin is trading at $56,188, up 3.3% in the last 24 hours.

Read also UBS Group AG Reveals Significant Holdings in BlackRock's iShares Bitcoin Trust

Disclaimer: This content is for informational purposes only and should not be considered financial advice. The opinions expressed are the author’s own and do not necessarily reflect the views of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Important Notice: The content of this article is for informational purposes only and should not be construed as financial advice. chinwa.tech

assumes no responsibility for any investment decisions made based on the information provided herein. It is strongly advisç zed to seek the guidance of a qualified specialist or financial advisor before making any investment choices.